Friday, December 19, 2008

Take it to the limit

I will welcome any bonus money that may come to me, as well as the "extra" check in January (it's a 3-check month). Both will go directly into savings. I've already "treated" myself enough this year.

Tuesday, December 9, 2008

December 2008 Net Worth

Checking: $380.77

ING Funds (total): $254.00

Roth IRA: $3,390.94 (out of the $4,900 I've invested so far)

401k: $668.96 (out of $882.64 invested)

Prosper: $60.83 (out of $100 in loans)

Sharebuilder: $30.41 (out of $50 initial investment)

____________

Total Positive: $5,704.74

Rent: Paid

Phone: Paid

Credit card: $458.28

Student Loan I: $12,555.22

Student Loan II: $121.02

____________

Total Negative: $13,134.52

Net Worth: -$7,429.78

Clearly, almost everything that could've gone wrong has. I'm desperately trying to pull myself together. I'm returning nearly all of it, but for every package I return, two more show up in my mailbox. I still don't know how this happened.

Tuesday, October 28, 2008

November 2008 Net Worth

Checking: $917.32

ING Funds (total): $361.78

Roth IRA: $3,138.44 (out of the $4,900 I've invested so far)

401k: $621.53 (out of $882.61 invested)

Prosper: $12.25 (out of $100 in loans)

Sharebuilder: $26.65 (out of $50 initial investment)

____________

Total Positive: $10,716.21

Rent: $825.00

Phone: $50.00

Credit card: $3,217.30

Student Loan I: $12,771.10

Student Loan II: $208.06

____________

Total Negative: $17,071.46

Net Worth: -$6,355.25

Not only am I losing buckets of money from my retirement accounts, I am currently spending like I never have before. It makes me ill to see these numbers, and it will take me months to regain the losses I incurred.

Wednesday, October 1, 2008

October Net Worth

Checking: $922.04

ING Funds (total): $1,207.78

Roth IRA: $4,048.12 (Out of the $4,700 I've invested so far)

401k: $686.12

Prosper: $9.18 (out of $100 in loans)

Sharebuilder: $38.49

____________

Total Positive: $12,239.97

Rent: $825.00

Phone: $50.00

Credit card: $1,480.74

Student Loan I: $12,956.21

Student Loan II: $383.00

____________

Total Negative: $16,300.95

Net Worth: -$4,060.98

Ouch. I've fallen into some bad habits. We've been lax on the bookkeeping, but I believe I've got a few hundred dollars coming to me from my boyfriend for furnishings reimbursements. I have been shopping like mad, however, which needs to stop. Some of it I "need," like new pants; I'm down a couple sizes, so I literally have no pants... although, I could just invest in a belt. I do have enough jewelry though, and going down a ring-size isn't a good enough excuse for a new ring wardrobe.

I did, however, finally get my weight-loss benefit reimbursement of $150 from my insurance company, which was put directly toward my loans. Plus I've been remembering to bring my lunch almost everyday, which has done wonders for my waistline, at least.

Thursday, September 11, 2008

I know the graph looks really bumpy, but it's because they only show it for a certain time period. If it were an option to zoom out, you'd see a more even trend. :P

Monday, September 1, 2008

September Net Worth

Checking: $2,629.66

ING Funds (total): $341.98

Roth IRA: $4,289.35 (Out of the $4,500 I've invested so far)

401k: $599.76

Prosper: $6.12 (out of $100 in loans)

Sharebuilder: $42.86

____________

Total Positive: $12,209.73

Rent: $825.00

Phone: $50.00

Credit card: $944.88

Student Loan I: $13,176.10

Student Loan II: $530.07

____________

Total Negative: $15,526.05

Net Worth: -$3,316.32

Wednesday, August 27, 2008

Open Wallet!

One of my insane purchases was an $80.00 bag at TJ Maxx, and not a week later, I find myself rifling through a neighbor's recyclables to pull out 3 tubes of wrapping paper (there was plenty left!).

Monday, July 28, 2008

August Net Worth

Checking: $98.00

ING Funds (total): $1,201.98

Roth IRA: $4,207.89 (Out of the $4,500 I've invested so far)

401k: $496.14 (Total loss of $23.06)

Prosper: $3.06 (out of $100 in loans)

Sharebuilder: $41.86

____________

Total Positive: $12,252.13

Rent: Paid

Phone: $50.00

Credit card: $2,089.77

Student Loan I: $13,302.57

Student Loan II: $599.08

____________

Total Negative: $16,041.22

Net Worth: -$3,789.09

Thursday, July 24, 2008

Fudge.

And it's official, I'm visiting my hometown in 3 weeks. As I said before, I'd like to lose more weight before I see my parents, and at this point, even a little would do.

Oh, and I have a new hobby...

.

..

...

which I will divulge as soon as I've taken some pictures. Ciao!

Thursday, July 17, 2008

Got to keep on movin'

Also, I lost 2 lbs. this past week, so I'm officially back in the saddle, with a total loss of 18 lbs. since I started losing at the end of May...and 30 lbs. since last summer!!

Monday, July 14, 2008

Spending Time, Spending Money

We are still in the process of buying furnishings for the new apartment, so my savings rate is flat. It's really sad, because I had planned to get my emergency fund back up to $6k by now. I'm losing $100 here, $400 there, and with my large rent bill every month, it's hard to gain footing. Luckily, August is a 3-paycheck month, so I can do a little catching up with some careful planning.

Speaking of careful planning, I am contributing like mad to my Roth IRA, but only because I've been attempting to time the market. I know it's stupid, but I see a low price, and say to myself, "even though I've already made my purchase for this month, I'm sure this is the lowest the price will go, so I better get while the gettin's good." Then, I invest $250, and the price drops $0.30. Rinse, repeat! Thank goodness there's a ceiling to how much you can invest in one year, or I might play this game until my bank account is empty!

My other large expense, as I've discussed before, is my weight-loss program. However, in recent weeks, I have not been doing well. 2 weeks ago, I only lost 1 pound. Last week, I gained 0.5 lbs. Not a big deal, I know, but it stresses me out and only exacerbates the problem. Obviously I've hit a plateau for a couple reasons: (i) I haven't been getting in much physical activity, and (ii) I've become more comfortable and much less compliant with the diet. At this point, I can't afford any allowances. I've come so far, and I can't stop now. I think I'll take a walk at lunch today...

Monday, July 7, 2008

July Net Worth

Checking: $389.95

ING Funds (total): $1,286.61*

Roth IRA: $3,699.15 (Out of the $4,000 I've invested so far)

401k: $393.45 (Total loss of $22.01)

Prosper: $1.24 (I've given $100 in loans, this is what has been paid back so far)

Sharebuilder: $41.69

____________

Total Positive: $11,167.94

Rent: Paid

Phone: $50.00

Credit card: $619.86

Student Loan I: $13,549.08

Student Loan II: $789.33

____________

Total Negative: $15,008.27

Net Worth: -$3,840.33

*This includes the $50.00 Sharebuilder bonus I just received, and $20.00 in ING referrals!

Sunday, July 6, 2008

Bottle up and Explode

- I went shopping... at Banana Republic. Granted, I hadn't bought new clothes in maybe a year, but I should lose about 5-8 more pounds before I go blowing my money anywhere, let alone BR.

- I only lost a pound this past week (total: 16.5 in 6 weeks). I've let my diet slip, and I keep making allowances, which only lead to more allowances. Case in point: I had gummy candy for lunch and a feast of bread and butter for dinner tonight. Ugh.

- My fingers are raw from biting. I've covered 8 of them in band-aids.

Back to work tomorrow, which is a huge bummer, but at least it'll give my day some structure.

Thursday, June 26, 2008

Some Goals

Now's a good time to mention that, prior to starting my weight-loss program, I lost 11.5 lbs over about 11 months, which means I've lost a total of 27 lbs since last summer. Maybe you've noticed that I haven't talked about goals yet -- it's because I haven't made any. The "end" has always seemed so far away. Now that it's more within reach, I think it's time to sketch out some goals. Here we go (x=my current weight):

- Short-term: x-8 lbs in 3 weeks. My bf's firm is having some event in mid-July, and significant others may or may not be invited (we're waiting on confirmation). I haven't met anyone at his job yet, and I'd like to make a good first impression, which basically means I'd like to be down one more size by then, and while we're at it, I'd like to stop gnawing on my cuticles so I can shake hands with abandon.

- Mid-term: x-15 lbs in 6 weeks. I'm thinking about a visit home in August, and I'd like to surprise them. They do know about my weight loss, but it's always fun to see it in person (this would be about what I weighed junior year of college).

- Long-term: x-35.5 in 16 weeks. Honestly, I haven't weighed this little since the end of high school, but I'd like to get there again. My parents will also be visiting me in October, so that would be nice. I don't know how realistic this time frame will end up being, and I'd probably be perfectly happy at x-25.5, but we'll see!

Thursday, June 19, 2008

Weighty matters...?

I'm happy to have made this progress, and I like to think that any amount of weight I lose is priceless, but in reality, the money I've spent only covers 4 or 5 more weeks. After that, I'm going to have to make a decision about whether I want to sign up for another 8 weeks, which would set me back another $600+.

It's easy enough to say that I shouldn't sign up, and that I should just do it on my own for free. But that's what I had been doing, and I didn't get very far. I'll have to give this a lot of thought before I make a final decision, but I'm leaning towards spending the money. It is my health, after all.

Monday, June 16, 2008

I Love Resale.

I finally found a place where you can get good quality resale furniture without the markup of a consignment or vintage shop (or the awkwardness of Craigslist). There's this place sort of nearby that's a non-profit, and all their proceeds go to AIDS services, education, and advocacy. What more could you ask for? We got a set of solid wood table and chairs for $100 this past weekend, and the weekend before, we got this awesome pair of wooden chairs with leather seats for $40! Whenever we want to make a trip there, we just rent a ZipCar for a few hours and go! Now, if we could only find some couches...

Thursday, June 12, 2008

Mayor of Sandwich

On a related note, I lost 3 more lbs this past week for a total of -10.5 in 3 weeks!

Tuesday, June 10, 2008

June Net Worth

Checking: $320.93

ING Funds (total): $2,311.17

Roth IRA: $3,460.60

401k: $418.96

Prosper: $100 (I received my $25 sign-up bonus this week!)

Sharebuilder: $45.03

____________

Total Positive: $12,062.54

Credit card: $1733.59

Student Loan I: $13,702.77

Student Loan II: $903.22

____________

Total Negative: $16,339.58

Net Worth: -$4,277.04

Not good!

My spending is definitely under control (remember, I charge ALL purchases*, so that means I only spent a few hundred on food AND entertainment this month), but my medical bills this month alone totaled about $650. Add $725 for the new mattress, and that's $1,375 on the credit card right there... and we still have way more furniture to buy.

It's not fun to see my finances slipping backward, but I have to stay positive. I am only now beginning to make real changes in my life, and my health will benefit. I have to think long-term.

*I definitely don't recommend this method unless you pay your bill in-full every month.

Wednesday, June 4, 2008

New Place, No Internet!

And let me just say that being TV/music/computer/internet-less for the past few days has been quite an experience. There's nothing that makes you feel more boring than realizing you have nothing to do (besides read) when those things are absent.

...In conclusion, more posts when I have internet!

(And, if anyone's keeping track, I lost another 3 lbs this past week.)

Wednesday, May 28, 2008

I could sleep when I lived alone

Life is change. I know it. I've accepted it, and maybe I even embrace it a little [begrudgingly]. But this is kind of unacceptable that all these huge expenses are coalescing into a trinity of awful:

- We just bought a mattress for about $750.

- My weight-loss program will cost almost $700 for just 8 weeks, which, as you now know, is almost the price of a mattress.*

- My rent is about to increase $300 per month.

Seriously, I've got to seriously think about getting a part-time job...seriously.

On a completely unrelated note, how does everyone feel about bridge (the card game)? I know it's screams "grandma" in a huge way, but don't you think it's about time for a come-back?

*I lost 4.5 lbs this week.

Monday, May 26, 2008

Prosper and ShareBuilder

It's been a busy weekend, finance-wise.

I signed up for Prosper yesterday (if you're not familiar with it, here's a recent article from CNNmoney.com -- it's pretty exciting.). They're running a promotion through June 30th where, if you sign up as a new lender through a referral link, both referer and refered will receive a $25.00 credit to their accounts. You'll notice I've added my own Prosper referral link in the side-bar to the right for anyone interested in signing up. I'll update with a detailed progress report as soon as I see some action.

As for ShareBuilder, I actually ran into a promotional code for a $50.00 credit (!) with any new ShareBuilder account. On the first screen after you click "Get started today," check the box that says "I'm responding to a promotion," and a blank will appear where you can type either of the following codes:

50GO28

50CITIZENS

After that, all you have to do is either set up an automatic investment of at least $50.00, and your account will be credited in 4-5 weeks.

I'll keep you posted with any updates!

Sunday, May 25, 2008

ING referrals

Before I opened my account last year, I had one large mass of money in my brick-and-mortar money market account. I really didn't have any goals for it except to see it grow, which it did at a sluggish pace of about 1% APY.

When one of my friends referred me to ING, I was kind of uncomfortable with the thought of opening an online account... but then I realized that I wasn't a dinosaur and I should stop being such an old person. I opened a savings account, and the rest is history.

Currently the interest rate is at 3%, which is infinitely better than you'll find at most banks. So here's the deal: if you use one of the links below to open a savings account at ING and make an initial deposit of at least $250.00, ING will immediately credit your account with $25.00, I'll get $10.00 for referring you, and you'll have your own referral links to hand out. These links are single-use only and expire on August 2nd, so please leave a comment letting me know which link you've used, and I'll replace it with a fresh one. Thanks!

Referral Link #2

Referral Link #3

Referral Link #4

As I've said before, I recently set up some "sub-accounts" with ING, and it's been a wonderful way to track my savings while planning for the future. ING is the most user-friendly online bank that I've ever used (I also tried Capital One), it's secure, and I trust them, which is probably the most important factor when money's involved.

Friday, May 23, 2008

[Almost] June Net Worth

Emergency Fund: $5,200.78

Checking: $61.00

ING Funds (total): $1,946.00

Roth IRA: $3,300.00

401k: $415.00

____________

Total Positive: $10,922.78

Rent: Pre-paid

Credit card: $427.55

Student Loan I: $13,751.58

Student Loan II: $901.00

____________

Total Negative: $15,080.13

Net Worth: -$4,157.35

The whole thing's tumbling down

We're the same age, and we've known each other since high school, so we've always been on the same plane, but now it feels like he's got a direct, first-class ticket, while I'm sitting with the screaming babies on a connecting flight to hell. Not to mention the contentious gender issues. I know I shouldn't bring work into the bedroom, but until now, our relationship has always been equal.

Forget salary inequalities...what do you do when your partner is more important than you are?

Wednesday, May 21, 2008

Marriage and investments?

My boyfriend will start his last year of law school in the fall. Right now he's got a summer associate position at one of the top firms in this city, and in all probability, they'll hire him after graduation. The starting salary is huge -- it alone is too large to qualify for a Roth IRA. Add my salary to that, and it's hopeless. Knock wood, but if we get married in the next few years, that only leaves 2 or 3 years of Roth IRA funding I can do. Not the worst problem to have, I know, but I just opened it.

Monday, May 19, 2008

Sleep Accessories

Could anyone fling any mattress-pricing-related advice in my direction?

Wednesday, May 14, 2008

That's the sound of a [wo]man working on the chain gang

She's in her early 30s with 3 credit cards, and she carries a balance on all of them. She says she pays the minimum balance on them, and sometimes tries to pay a bit more, but she has no plan. She's basically living paycheck to paycheck (unnecessarily) and charging food (is that $2 muffin really worth $5?). I recommended Dave Ramsey's book as an inspirational tool for her situation, but I'm not sure she was seeking advice.

She did say something that really struck me: "I'm not worried; I'll get out of debt sometime."

Unless you're taking steps to be proactive about doing something, "sometime" will never come, and your debt will just keep mounting. Unless it's concrete -- unless you have a plan -- unless "sometime" becomes "today," or "December 31st," or "in 3 years," it's not going to happen.

Sunday, May 4, 2008

Furniture shopping!

($700.00 chair from IKEA!)

Anyway, I was looking at Victorian-era furniture at the antique market, and I found a few pieces with beautiful bones, but awful upholstery. I found a stained "couch" for $125, and a regal chair (with dark green velvet) for $150.00. I'm not really into velvet, but if I was a whiz at upholstery, I'd have swooped up those items in a heart beat.

Has anyone ever completed such an undertaking?

Where does the good go

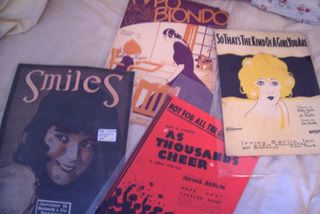

As I am in the market for any household-goods frugal finds, I decided to stop by my local antique market to browse. There was a lot of framed work, which I would've loved to get, had it not been so ugly. There was one nice piece, but it was $995. No thanks! I did find some sheet music that I thought would look nice matted and framed, though that might get expensive. These range in date from 1918 to 1933, and they were each between 4 and 10 dollars. Thoughts?

For a couple dollars, I founds these photos at a small antique store last year (plus a ring and a necklace). It's sort of weird displaying family photos that aren't your own, and I'm not sure how to do it. Does anyone have any suggestions?

Also, I really like jadeite and milk glass, but I couldn't find anything in good condition. I think it had all been picked through. I got these clear green glasses with opaque tops at Anthropologie for $12.00 each. Decidedly not frugal, but they're beautiful, and I'll be using them on my future vanity.

Saturday, May 3, 2008

I Gotta Move

I have a lot of free time. I have no commitments except to my full-time job and my boyfriend. I spend a lot of time wasting time, not even pretending to do anything productive. Now, all of the sudden I'm 24, and I feel that I've accomplished little since college graduation.

It seems that all this idle time is pretty counterproductive. As I mentioned in prior posts, I'm thinking about getting a part-time job. Since my rent is going up about $300 per month, I'll need some extra cash to avoid feeling strapped. More importantly, I'm alone a lot, which is turning out to be not so healthy for me.

Right now, I interact with an office of about 9 other people, and I see my boyfriend for a few hours over the weekend. And that's it. It's awful, but I don't have friends. I expect a part-time job to provide me with more (i) companionship of people around my own age, (ii) money, and (iii) perspective. Being alone all the time does nothing for that third one.

If anyone would like to share a related experience, I'm all ears.

May Net Worth

Money Market: $4,519.20

ING Accounts: $1,364.06

Roth IRA: $3,132.27

401k: $311.52

___________________

Total Positive: $9,672.05

Credit card: $639.16

Student Loan I: $13,919.34

Student Loan II: $998.59

___________________

Total Negative: $15,557.09

Net Worth: -$5,979.89

My savings clearly took a big hit this month because of my Roth IRA and the new apartment. The up-front costs for me alone were over 2k (!). Instead of replenishing my savings with my $600.00 rebate as I had originally planned, I put it towards my loans. I also got $100.00 from my grandmother for my birthday, and it's just sitting in my checking right now until I figure out what to do with it.

Thursday, May 1, 2008

Quick review of Geezeo

Problemos:

I was able to easily add my main banking information, but when I tried to enter my ING information, it didn't recognize the bank (I think they did have ING Direct - CN, though... but isn't that Canada? In any case, it didn't work).

After "finding" my retirement account information, it never logged it onto my page. Weird.

I thought they also gave you the ability to add student loans, but apparently that feature isn't available yet.

Conclusion:

Basically, the way it's functioning for me, it's just a really convoluted method of checking my bank balance. But they already have a website for that. When they add student loans, maybe I'll be back.

Wednesday, April 30, 2008

Decorating Dilemma

My parents are giving us some things, but we don't even have a couch. I'm going to try to rely heavily on craigslist, of course, but even refurbishing gets expensive (e.g. these examples in Sunset Magazine). This one really cuts deep, because nothing gets me going like mirrored side-tables (see before and after below).

Sunday, April 27, 2008

Just about a moonlight mile on down the road...

However, I've decided it's now time to start livin' in sin. In fact, my boyfriend and I just signed an application for an apartment about a mile and a half from my current place, which would be almost 23% of my gross income (and something like 31% of my net income) just for my half of the rent.

The flurry of activity in my checking account is making me so uncomfortable. I can see all my hard-earned money slipping through my fingers as I type this. We decided on this apartment because all the other ones we saw were more expensive and smaller. Living like sardines doesn't appeal to us, but it's not like I'm looking for luxury. I don't get how anyone affords to live in this city.

Friday, April 25, 2008

Head Under Water (but a bit better than last time?)

Emergency Fund: $8,709.20

Checking: $109.00

ING Funds (total): $1,365.54

Roth IRA*: $3,100.00

401k: $311.52

____________

Total Positive: $13,595.26

Rent: $530.00

Credit card: $710.00

Student Loan I: $14,902.85

Student Loan II: $1,242.14

____________

Total Negative: $17,384.99

Net Worth: -$3,789.73

Have I left anything out?

*hasn't cleared yet

Birthday Present

I knew if I didn't start out with something simple, there was a good chance I'd put it off forever, so I opened a Vanguard Target Retirement account.

Of course, now I'm sitting here tapping my fingers, waiting for them to take my initial deposit. Is this really going to take 8 days to happen? Are people going to be getting their economic stimulus checks early and start driving up the prices before I can get my shares? Does that happen? Rawr.

Thursday, April 17, 2008

Orthodontia ain't cheap

I had a consultation today with the orthodontist who did my braces. He confirmed my concerns and said he could totally fix everything with Invisalign! YAY, right?!? $5-$6k worth of "yay."

So I'm conflicted. While I would love to dive right in, I feel it would be a financially irresponsible move right now for me. How does anyone feel ok about spending that much money on a non-essential procedure?

Monday, April 14, 2008

401K

Apparently, the employer contribution is 100% vested immediately when it goes into the account, which is good/weird, because I thought the vesting schedule said it wasn't at all vested until 3 years have passed. I'm still unclear about when the match actually goes into the account, because I have yet to see it. I think he might have said the end of the calendar year, which is kind of a bummer.

Taxes

Rather, I paid TurboTax the $30 to file for me. And you know what? It was worth it. The little refund-counter in the upperleft corner scrolling up through the numbers made it feel like I was winning the lottery.

I got a $402 federal refund and a $126 state refund. Add that to my projected $600 tax rebate, and I've got $1128 to put toward moving expenses. And since I could be moving earlier than expected, it could not have come at a better time.

Which reminds me...

Right now, about 20% of my take-home pay goes toward my rent. When I move, I'm probably looking at a huge rent increase (to about 30-37% of my take-home pay, and that's only if I don't change jobs). How am I supposed to be able to absorb that? I guess it's my fault for choosing to live in this city!

Friday, April 11, 2008

Raggedy Ann

Well, I'll tell you.

I splurge on anything vaguely medical. Or, let me clarify: I splurge on anything masquerading as necessary medical care and/or aesthetic preservation, including, but not limited to the following:

- Diet. I'd call Jenny, attend Weight Watcher meetings, or lay down $100.00 for a bottle of quality Rx-grade supplements. Just show me where to sign.

- Dental care. Less gladly, but just as quickly, I'd hand over the wallet.

- Skin care. I would use Retin-A and/or Differin even if my insurance plan didn't cover the cost. I contemplated Botox, but knowing me, I would get temporary eyelid paralysis.

I also go out to eat a lot. I never order drinks or apps, so that really cuts down on the cost, but I am a big tipper, so at least there's that?

Otherwise, I try not to hemorrhage money.

Grow Up and Blow Away

Student Loan Fund

Future Fund

Roth IRA

Medical/Dental

Gifts

I am planning to move sometime in either June or September (don't ask), so my "Future Fund" will cover some moving expenses, plus deposit and first month's rent... unless I end up having to move in June, in which case, there won't be much money in there. I'm also planning to start saving for a wedding in case I want to get married in the next 10 years. A house would also presumably fall into this category.

I have a "Medical/Dental" category because of an awful, mostly unexpected $850 dental bill I got this year. It's never fun to take that big of a chunk from your savings. While I do plan to save $50/paycheck into this account, I think next time I'll use CareCredit. I've never used it before, but my mom works in the dental field, and recommended it. It's normally interest-free for 3-18 months. If I knew for sure that I had money set aside to pay for it, why would I use it? Well, I guess I wouldn't if I had the money set aside, but I would use it to avoid dipping into my savings.

"Gifts" is its own category, because, now that I'm a fully-functioning adult person, I'll have friends getting married any day now. That's a lot of gifts.

I thought about adding a "Clothes" fund, but I buy clothes infrequently enough not even to bother.

What are your categories?

If you still haven't opened an ING account yet and you'd like to, leave a comment for a referral. You get $25.00 for free for signing up and depositing at least $250.00, and I get $10.00 for spreading the word.

Wednesday, April 9, 2008

Friends with Money

He's 23 too, and has saved up about 45k so far (not including the approximate 20k in retirement funds -- I think his salary is around 70k). And here I thought I was doing well!

Sunday, April 6, 2008

Now that your wallet is all lit up

But I was wrong, because here they are (before I change my mind):

Emergency fund: $10,000.17

Checking: $224.53

401K: $207.68 (this is the amount I've contributed so far -- I have no idea how much is actually in the account)

Total Positive: $10,432.38

Credit card balance: $594.23 (paid in full monthly)

Student loan I (at 4.75%): $14,823.80 (started at 17,381.00)

Student loan II (at 5%): $1,227.37 (started at 1,640.00)

Total Negative: $16,645.4

Net Worth: -$6,213.02

My trigger finger's itchin' to put most of my emergency fund toward student loan I.

Saturday, April 5, 2008

Multiply

First, I'd like a little extra money. Ideally, that extra money would also come with discounts on things I need, like clothes or food, or other perks.

Another big issue is that I'm still on the prowl for a future, and by that, I do mean a career. Even more than the first 2 requirements, it's essential that I try some new things out and find something I'm interested in.

Does anyone have any success stories to share with me?

You were young, and man, you were sad...

So for those of you still unsure whether your boss is a bully, here are a few favorite bully pastimes:

1. Excessive yelling, screaming, shouting, or swearing;

2. Sarcasm, haranguing, and public humiliation; and

3. Treating the underlings like shit.

Please note, this is not to be confused with valid criticism. A lot has been made of Gen-Y's need for incessant fawning and praise. Some people are more adept than others at taking criticism, and ideally, your first job should thicken your skin a bit. While criticism is tough, it's also necessary, and in the end, invaluable to your progress. This post is not about that -- it's about workplace abuse.

While, admittedly, there are a few strategic reasons to be an asshole, there are far more reasons not to be, including the following:

HIGH TURN-OVER

No one likes to work with assholes, especially when those assholes are in positions of authority. The new hires get out before they get sucked in.

NO NEWS IS GOOD NEWS

Employees will go out of their way to avoid reporting bad news to asshole bosses. For that reason, the business could be falling apart, while the boss is none the wiser. Productivity also goes down when people are obsessed with hiding things, or worried about the next nuclear fall-out.

ILLNESS (AND "ILLNESS")

Whether the illness is legit, fabricated, or imagined, asshole bosses cause more sick days that non-asshole bosses.

SAD, ANGRY ZOMBIES

Bullying creates sad, angry zombie employees, and everyone knows zombies eat brains. Just sayin'.

I think I'm past-due for some defunkification.

Salary Malaise

Pros: A salary guarantees a steady flow of money each month as long as you're employed. Your paycheck is written out for the same amount every 2 weeks. There are no surprises.

Cons: There are no surprises. No matter how many hours you log, or how hard you work (or not), the numbers are always the same. Where's my motivation?

I'm not asking for a lay-off, thankyouverymuch, and it's not time for a raise, so I'm thinking about getting a part-time job for a little extra "surprise" money at the end of the day, some social interaction, and perhaps a field-trip into uncharted occupational territory.

Thursday, April 3, 2008

Calculation Theme

As a 15-year-old cashier at Kroger, I didn't appreciate when old ladies would hand me fist-fulls of coupons that wouldn't scan. I wasn't such a hard-ass though. Instead of arguing, I manually entered expired coupons and coupons for different merchandise (what did I care, right? Also, was that seriously almost 10 years ago?).

Now I'm on the other side of it, and I feel like the cashier has a similarly low opinion of me. Using multiple coupons also sort of feels like stealing, which makes me incredibly nervous, but also a little excited. Sort of like that IKEA commercial where that woman is running out with all the new stuff she bought incredibly cheap, screaming at her husband to start the car, as if she had just pulled of a heist.

But seriously, does anyone else feel dirty, especially when combining coupons?

Tuesday, April 1, 2008

A word from the expert

I thought I would get a thumbs-up on my plan for a Vanguard Target Retirement 2050 fund. Instead, he countered with Permanent Portfolio. I've never heard of it, but looking at the breakdown, it seems excessively conservative. His explanation was that this Vanguard target fund is relatively new, but Permanent Portfolio has been around since 1982, and has performed well, even in the last bear market. Ok, I'm down... maybe. The fees are higher than Vanguard's, but he said it might be worth it in the end.

I'm still worried it's not aggressive enough. Anyone want to throw any other thoughts into the pot for consideration? I'm fixin' to set this shiz to simmer while I go do my taxes [finally].

Sunday, March 30, 2008

Flight of Fancy

When I was younger, I think I thought this is what my 20s would look like.

Now, I start fires, but not deliberately. I don't even own an apron. I rarely harness a stool's bongo-like qualities for an impromptu drum circle, and I definitely can't sing and serve at the same time. The kitchen in the apartment I rent is an eighth the size of that one. And there is for sure no dancing.

Maybe someday I'll find myself cooking in a good sized kitchen, cranking out some crunchy grooves, but for now, it's just me and the microwave.

Saturday, March 29, 2008

Love in the Library

I learned to do without, that is, until, at the urging of blogs like Get Rich Slowly, I finally trudged over to the local branch to register. Sure, the DVD selection is a little lackluster (and sticky), but it's free, which beats the hell out of a $40 per month video bill.

I might have to pick up some latex gloves if I keep this up (what is that mysterious, pervasive stickiness??), but they will more than pay for themselves after a few visits.

...But seriously, is it slobber? A food substance? An antiquated anti-theft mechanism? I'd like to see a breakdown...some bar graphs or something.

Thursday, March 27, 2008

Family Money

I remember that money was something we didn't have, but managed to spend nonetheless. Our financial situation, to me, wasn't malleable. Instead, save the idea of a windfall, you either had money, or you didn't, and whether you did was almost a moral issue. We were "poor" like some other families were "nice." Of course, I can't objectively say how much we didn't have, but this is what I remember.

My mother had a bad TV-shopping habit, which kept the collectors ringing at all hours. I believe it was from her that I learned [non-]impulse control. These tendencies spilled over into the grocery cart, too. A gallon of ice cream half-eaten, followed by some self-flagellation, and then in the garbage it went.

My father thought himself quite frugal. He wasn't constantly buying things like my mother was, but he wasn't careful with money. His favorite things to say were, "we can always buy more," or "if you want it, get it," which always puzzled me ("with what?", I thought). A hard combination of pride and denial, I'm sure.

My parents are in their late 50s, and they have no savings. My bat-mitzvah money and part-time, minimum wage paychecks were contributed to the family pot. I was always willing to give up my money -- to my parents, my clientele, to anyone, really. I remember, as a 14 year old, refusing money after baby-sitting all day. I thought accepting the money would be greedy.

I'm sure Suze Orman would have a field day with that last bit. Is self-undervaluation like this exclusive to females?

Wednesday, March 26, 2008

Straight up, now, tell me...

I have yet to open a Roth IRA.

For the past year, I've yammered on to anyone who would listen about my grand retirement plans, but I've neglected to actually do anything. Now, with the economy downturn, I'm in need of some sound advice (and a push).

I am willing to contribute all or part of the 2007 max before April 15th, but keeping the current state of the economy in mind, what is the best move I can make right now?

Other factors to consider:

- I saved 7 to 8 months worth of living expenses, the balance of which is sitting in a money market account, gaining only about the price of a movie ticket each month (because of plummeting interest rates).

- My student loans > my savings account balance. The loans are quietly accumulating interest at a rate of 4.75%.

Thoughts?